Tax FAQs

What are your charges?

Am I entitled to a tax refund?

You will almost definitely be entitled to a refund if you satisfy any of the following criteria:

- You are an overseas visitor working in the UK

- You worked less than a full tax year

- You earned less than the annual Tax Free Threshold (£10,600 for 15/16)

- You have been paying Emergency Tax

- You work through CIS (Construction Industry)

Am I entitled to claim even though I have a British Passport?

Do I have to submit a claim?

Firstly, a tax claim for overpaid tax is different to a self assessment tax return. A tax claim is voluntary and is able to be applied for by those on PAYE (i.e. where your employer deducts tax on your behalf). A self Assessment tax return is mandatory by law and you are obligated to submit one of these to HMRC if you are:

- Ltd Co Director

- Self Employed

- CIS Contractor

- Earn income from a property

- Earn over £100k per year

- Earn income from dividends

- You have been sent an SA100 Self Assessment Tax Return by the Inland Revenue

However it is always worth checking to see whether you are due a refund as millions of people are without knowing it.

What is the difference between a tax rebate/refund/claim and a tax return?

How much will I get back?

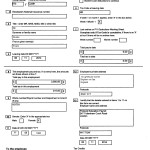

What do I need to do?

P45/P60/Statement of Earnings?

P60 – Document detailing your earnings and tax paid during an employment until 5 April. Employers issue them at the end of the tax year. They only issue one.

P45 – Document detailing your earnings and tax paid during an employment. Employers issue them when you leave an employment during a tax year. They only issue one.

SOE – Document on a company letterhead with the same details as the P60 and P45. Payroll can issue more than one, and are necessary when P60’s and P45’s are missing.

When should I claim?

If you are still working in the UK, you may submit a claim after the end of the tax year (5 April). If you have left the UK or are leaving during a tax year, you may submit a claim at any time.

How far back can I claim?

You can claim up to 4 years in the past. Currently from the 6 April 2012 onwards.

What if I don't have an NI number?

A claim may be made using a temporary NI number or even without one, although the claim may be dealt with less efficiently and with more delays. An NI number allows Revenue to locate your tax records, although there are other pieces of information that will bring up the information they need such as address, post code etc.

Can I claim for only my main job if the rest were very short and don't seem worthwhile?

No, you are required to declare each and every income you had during the tax year. This even applies to jobs as short as a couple of days.

Am I paying emergency tax?

If your tax code contains any of the following as a prefix or suffix : W1, M1, BR, X, WK1, MTN, you are paying emergency tax. This happens if your employer is unsure how much you should be taxed and as such you are taxed on a weekly or monthly basis as opposed to an annual basis. You will find your tax code on your payslips, P45s and P60s.

When is the financial year?

From the 6 April to the 5 April of the following year.

How long will it take to receive my refund?

Inland Revenue give a timeframe of 4 – 8 weeks for a claim to be processed and the refund to be received. The average turnaround time however is about 6 weeks.

Where does the refund go?

For those on PAYE or CIS, you will be given a choice of payment options when completing an online webform.

Option 1. The cash goes directly from the Inland Revenue to you. This ensures that there is no risk of not receiving your refund for any reason and aims to give you peace of mind. This is the preferred option.

Option 2. Your refund goes to Claimtax.co.uk first, from which we deduct our fee and send the remainder to your UK or overseas account. For those Self Assessment/Self Employed clients, any refund you may be due will go directly to your UK account.

Is Claimtax bonded by the ATA (Association of Tax Agents)?

No, there is no need for Claimtax to be bonded to the ATA.The ATA is body that guarantees the refund of a client if the company claiming on their behalf goes out of business. However the companies that the ATA warns against operate differently to Claimtax in that they receive the clients (your) refund first, into the company account and then take their commission from that amount and pass the remainder on to you. Therefore the danger of losing your refund if these companies go out of business is real. This is the way that 99% of companies offering tax rebates work. Claimtax is different. While we do offer the option for our clients’ refunds to come to us first, our suggested option is to instruct Revenue to send your refund directly to your bank account or your address from the outset and at no time do we see or have any control over the money you are due to receive from Revenue. In this way, even in the highly unlikely event of Claimtax going out of business, there is no risk whatsoever of your money going missing or not being received by you.

Tax Rumours and Fines

There are many rumours that get spread about tax each year, one of the popular myths being that only those who work on a PAYE basis will receive a refund. While it is true that the majority of people who do receive refunds are on PAYE, many people forget that those who submit self assessment tax returns, and especially CIS Contractors, are often due refunds as well. Those on self assessment are obligated by law to submit tax returns at the end of every tax year. Failure to do so will risk heavy fines as well as daily interest being imposed by HMRC.